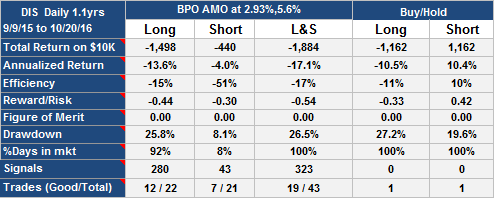

Here is a Walt Disney Company (DIS) trading strategy with daily maintenance which had quite nice characteristics; 59% annualized return over the last 2 years.

The performance was better than long buy-hold with lower drawdown and about three times the reward-risk. Signal reinforcement was good, and not many dual signal days.

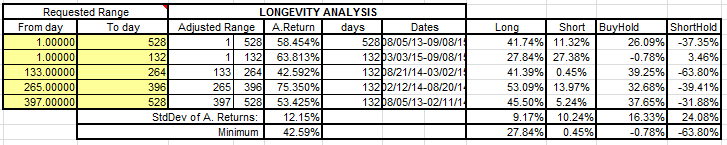

Below I show the return for the DIS trading strategy for each 6 month period going back 2 years. Comparing with long buy-hold you can see better consistency (higher minimum and lower StdDev).

Please note that this is simply a measurement, not an opinion or financial advice.

This post was corrected 1/8/2016 to correct a miscalculation in the short-side returns.

Update Oct 21st 2016

Strategy peaked 11/23/15, shortly after the stock price peaked.