Oil had a rocky year, lets look at how our multi-algorithm approach worked on an oil related stock, UWTI (VelocityShares 3x Long Crude Oil ETN). In this post, I'm just going to summarize the results:

Briefly, the method used is to run SignalSolver to find trading systems which worked for a 250 day period, then run these trading system against the data immediately following the 250 day period to see how they performed. This is known as out-of-sample testing as none of this following data is included in the optimizations.

The methodology is identical to my previous posts. If you need more details you can download the results spreadsheets, or download SignalSolver and run the optimizations yourself. I have omitted the result for the Return optimization on the PB band this time because I think we have established that the Figure of Merit optimizations usually work better. They do here.

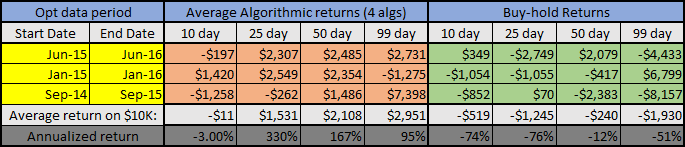

The idea is behind multi-algorithms is that using a single algorithm is risky, but running multiple algorithms at once averages out your risk and leads to more consistent and more efficient (since you are sometimes out of the market) results. Here, we averaged over the top 4 algorithms for each period.

You can see that the multi-algorithmic approach gave very good results for the 25 day (5 weeks of trading) and 50 day runs. If you look at the buy-hold profile you can see that you would have had a rough time guessing long and short entry and exits to get the same results. Not saying it couldn't be done, but using the multi-algorithmic approach would have given nice returns for UWTI with absolutely zero guesswork. And its based on sound numerical analysis, not hunches and tweets. Is anybody listening? 🙂